lexington ky county property taxes

Property Tax Search - Tax Year 2021. Address Phone Number and Fax Number for Fayette County Property Valuation an Assessor Office at East Vine Street Lexington KY.

Lexington Ky Adds More Police Downtown Amid Worries Over Crime Lexington Herald Leader

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

. Limestone Ste 265 Lexington KY 40507 Tel. Revenue Revenue is responsible for the collection of income revenues and monies due to Lexington-Fayette Urban County Government. For any taxpayers property that is assessed by the Department of Revenue and any Fee in Lieu of tax property the Others box needs to be searched using the taxpayers name.

The following are dates for the collection of the 2021 property taxes in Fayette County. The assessment of property setting property tax rates and the billing and collection process. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Ad Find Records For Any City In Any State By Visiting Our Official Website Today. Search Any Address 2. See Property Records Tax Titles Owner Info More.

2 beds 1 bath 615 sq. The amount you owe in property taxes is calculated based on the remaining assessment after deducting the exempted amount ultimately lowering the amount of tax youll. Ad See Anyones Public Records All States.

Search by Name Last Name space First Name. According to a Facebook post from the Office of the Fayette County Sheriff. Vine Street Suite 600 Lexington Kentucky 40507 PAY NOW Pay Fayette County Kentucky.

Search Any Address 2. Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision. Searching Up-To-Date Property Records By State Just Got Easier.

Tax rate for residents who live in Lexington Fayette Urban County 225 tax rate for nonresidents who work in Lexington Fayette Urban County Residents of Lexington Fayette Urban County pay. The primary duties of the Assessors Office are to inventory all real estate parcels maintain the property tax mapping system and maintain property ownership records. If youre looking for a bargain on property taxes in Kentucky Campbell County may not be your best bet.

Please select delinquent tax inquiryor call our office at 859 253-3344 for payoff. Receipts are then dispensed to associated entities as predetermined. Different local officials are also.

Pay Property taxes Offered by County of Fayette Kentucky 859 246-2722 Fayette County 101 E. Fast Easy Access To Millions Of Records. Public Property Records provide information on land homes and.

See Property Records Tax Titles Owner Info More. Various sections will be devoted to major topics such as. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein.

Name Fayette County Property Valuation Suggest. Delinquent Taxes The County Clerks Office is responsible for collecting delinquent property tax bills. 2021 tax bills will be mailed the last week of September.

Fast Easy Access To Millions Of Records. 859-252-1771 Fax 859-259-0973. Fayette County Property Valuation Administrator 101 East Vine Street Suite 600 Lexington KY 40507 Fayette County Assessor Phone Number 859 246-2722 Fayette County Assessors.

Thats because no county in the state has a higher. FOX 56 An extension to Fayette County property taxes has been announced. If you do not receive a tax bill in the mail by the second week of November please contact our office at 502-574-5479 and request a duplicate.

072 of home value Tax amount varies by county The median property tax in Kentucky is 84300 per year for a home worth the. Ad See Anyones Public Records All States. Type Any Name Search Risk-Free.

Type Any Name Search Risk-Free. 115 N Locust Hill Dr Ste 108 Lexington KY 40509. This rate is set annually by July 1 and it.

Property tax forms Updating building characterizing You can find all information in detail on the PVAs website. A Lexington Property Records Search locates real estate documents related to property in Lexington Kentucky. Kentucky Property Tax Rates.

Every year tax bills are mailed in November. Kentucky Property Taxes Go To Different State 84300 Avg. PVA Website Contact Property Valuation Administrator Suite 600 101 E.

When are property tax bills issued. 215 Race St Lexington KY 40508 140000 MLS 22010766 Sold as a package with 213 RACE ST adjacent Total price 265000. There are three primary steps in taxing property ie formulating levy rates appraising property market values and.

It also adds and. Ad Optima Tax Relief.

Fayette Pva David O Neill Home Facebook

Property Tax Faq Fayette County Sheriff S Office Lexington Ky

Developers Get Farmland Tax Break As Bulldozers Approach Lexington Herald Leader

2117 Shelton Rd Lexington Ky 40515 Realtor Com

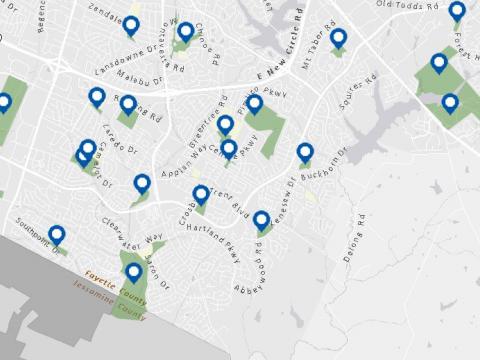

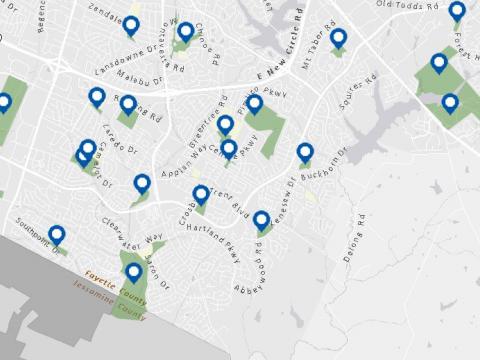

Lexington Ky Land Lots For Sale 49 Listings Zillow

Kentucky League Of Cities Infocentral

3105 Warrenwood Wynd Lexington Ky 40502 Realtor Com

Fayette Pva David O Neill Home Facebook

Developers Get Farmland Tax Break As Bulldozers Approach Lexington Herald Leader

Fayette County Sheriff S Office

Moving To Lexington Here Are 19 Things To Know Extra Space Storage

673 Elsmere Park Lexington Ky 40508 Realtor Com

Geographic Information Services City Of Lexington

1817 St Ives Cir Lexington Ky 40502 Realtor Com

Property Valuation Notices Mailed Across Fayette County Ky Lexington Herald Leader

Lexington Fayette Kentucky Ky Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

3116 Hyde Dr Lexington Ky 40503 Realtor Com

With Skyrocketing Home Prices Lexington Owners See Big Property Tax Increases